The Royal Science and Technology Park (RSTP) has been designated as a Special Economic Zone. This was done through the Special Economic Zone (SEZ) Act of 2018. His Majesty King Mswati III is the brainchild of such an initiative targeted at attracting foreign direct investment into the Kingdom of Eswatini. Such a drive is designed to help promote export-oriented growth, generate employment with the intention to ensure technology transfer to the Eswatini populace and subsequently stimulate economic growth. The Investor Management Services Unit is responsible for the operationalisation and management of the RSTP’s SEZ Industrial Plot and One Stop Shop Service Centre.

It is a multi-sectoral high-tech Special Economic Zone, that provides the best services and support to ensure investors enjoy our highly competitive incentive package such as:

Our ecosystem entails Professional Innovation Skills Academy, 3tier National Data Centre , Business Incubation Services ,a National Contact Centre and research facilities. The Royal Science and Technology Park commits to a safe and sustainable environment with our “plug and play” SEZ ecosystem, giving you access to regional and global markets, at your convenience.

The RSTP SEZ manages 317.7 hectares of land which its master plan comprise 159 hectares for industrial development ideally located in close proximity to import and export transport routes; through the highway access to Republic of South Africa and the Republic of Mozambique, dry port railway line leading to Maputo Sea Port (Republic of Mozambique) and Richards Bay Sea Port (Republic of South Africa).

Currently, atleast 80ha of the industrial development land at Nokwane is serviced and readily available for the potential targeted investments to set up shop. A Master Plan is in place for development of the basic infrastructure for the remaining 79ha of the industrial development land at Phocweni (the IT wing of RSTP).

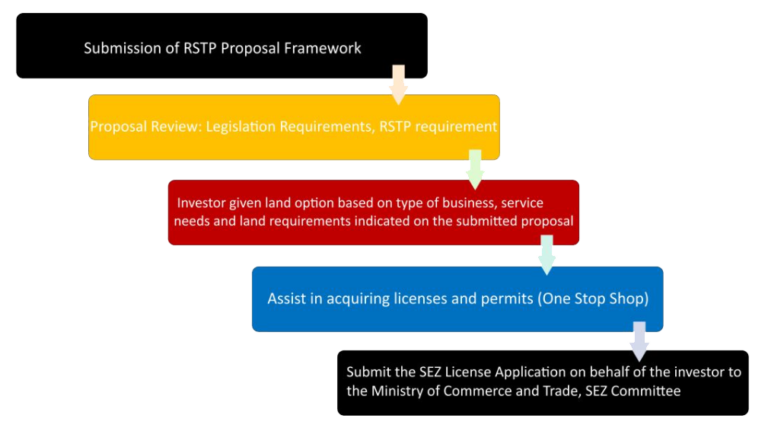

The One Stop Shop/Service Centre, which is near completion, is intended to ease and expedite the administrative processes and procedures of doing business within the SEZ. The OSSSC in an infrastructure which is to house all the relevant stakeholders that provides all the services that an investor may require when locating their investment at the SEZ.

Services provided to investors through the One Stop Shop include:

Access to Markets:

Access to markets via The Kingdom of Eswatini Free Trade and Preferential Agreements:

Fiscal and Tax

Non Fiscal

Business Units can provide services that can be outsourced which would allow investors to focus on their core business and to reduce infrastructure and operational costs.

In addition, RSTP’s Ecosystem also includes:

The initial capital investment for a sole proprietor is E30, 000,000 and E70, 000, 000 for joint ventures. An Enterprise or investor has to demonstrate their business case, the financial viability of theire investment, as well as the socioeconomic benefits of the proposed investment.

The Enterprise or investor intending to set up shall;

EARMARKED INVESTMENTS

Busile Dlamini

busiled@rstp.org.sz

Cell: +26876088608

Tell:25179410

Smemo Dlamini

simemo.dlamini@rstp.org.sz

Cell: 78070309

Tel: 25179410